Specializing in EV Charging and New Energy Ventures

Strategy

Analysis

Regulatory

Advocacy

Design

Implementation

Compliance

EV Advisors, LLC, is a nationally recognized leader in electric vehicle charging infrastructure. The firm supports innovators in all aspects of EV charging infrastructure deployments, from inception through implementation.

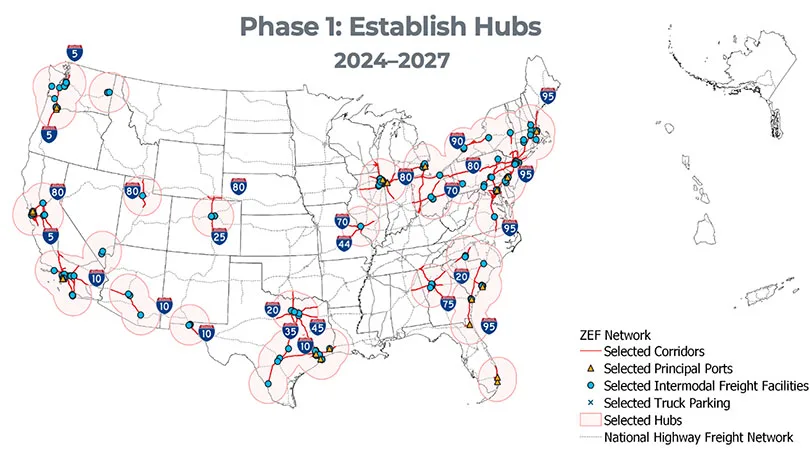

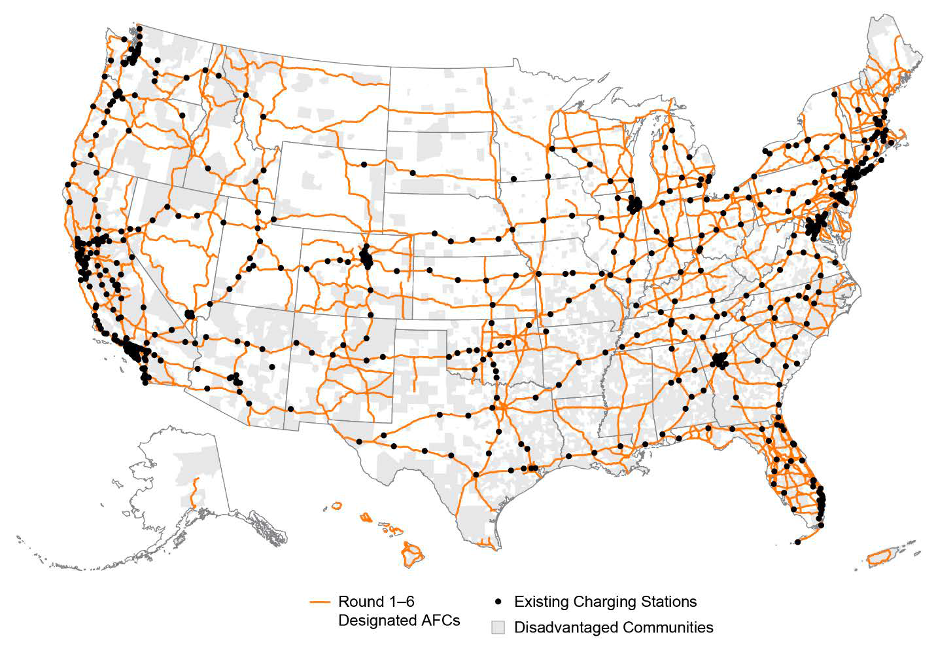

Clients include electric utilities, commercial landlords and developers, EV charging companies, energy infrastructure developers, fleet operators, vehicle OEMs, investors, engineering firms, and consumer engagement platforms. In guiding clients to successful commercial operation, the firm also helps navigate and leverage the Bipartisan Infrastructure Law as enacted in the Infrastructure Investment and Jobs Act.

In short, EV Advisors develops customized solutions across the EV charging value chain and we help clients create profit-maximizing opportunities and relationships.

Energy industry expert and EV charging infrastructure pioneer.

The EV Advisors team is led by Michael I. Krauthamer, who possesses a unique and extensive blend of commercial and regulatory experience. Building on a career in wholesale and retail energy policy, Michael entered the EV charging space in its infancy.

As an early hire at America’s first nationwide DC fast charging network, Michael’s EV-related achievements range from developing dozens of charging locations to regulatory successes to initiating federal legislation in support of EV charging, effectively helping to write the instruction book that guides today’s charging industry.

In addition to his commercial work, Michael serves as a senior advisor to the Alliance for Transportation Electrification, an organization which represents a broad and diverse coalition of EV industry stakeholders that advocates for accelerated investment in transportation electrification across America.

Over the course of his career, Michael has held positions at the Maryland Public Service Commission, the Federal Energy Regulatory Commission, the U.S. Department of Justice, and the White House.